Established Private, Non-Denominational Christian Schools in North Springfield & Alexandria, Virginia

Infant & Toddler

Springfield Academy & Spring ‘N' Dale Private School

are proud to offer highly effective and educational toddler and preschool programs.

Elementary School

Whether you have a youngster ready to start kindergarten, first, second, or third grade, they're sure to succeed at our elementary schools.

Extracurricular Activities

At our schools, we are proud to offer every student the chance to learn and grow through extracurricular activities

like music, dance, and karate.

Contact us to ask about enrolling your little ones at our private schools. Hours of Operation

Hours of Operation

- Mon - Fri

- -

- Sat - Sun

- Closed

We Speak English & Spanish • All Teachers Are CPR Certified • Family Discounts & Referral Programs Available • Tuition-Free Vacation

Subsidies We Accept:

•Office for Children •State-Funded Subsidies •Flexible Spending Accounts

Fall Lunch & Snack Menu

Menu items may change

Kindergarten Supply List

1 & 2 Grade

3 & 4 Grade

Tuition Rate and Fees

School Year Calendar

Special Events

Who We Are

Children at our private, non-denominational Christian schools in North Springfield, Virginia, come to love learning and enjoy a challenge. Springfield Academy & Spring ‘N' Dale Private School use the advanced ABEKA curriculum for everyone from two-year-olds to third graders, which allows each child to grow socially, mentally, verbally, and physically.

Our schools have been owned and operated by a Christian family since 1958. All of our teachers are CPR certified with backgrounds in early childhood education, and many years of experience in child care. We have teachers on staff that are medication administration trained, and daily health observation certified.

State Licensed • Established in 1958

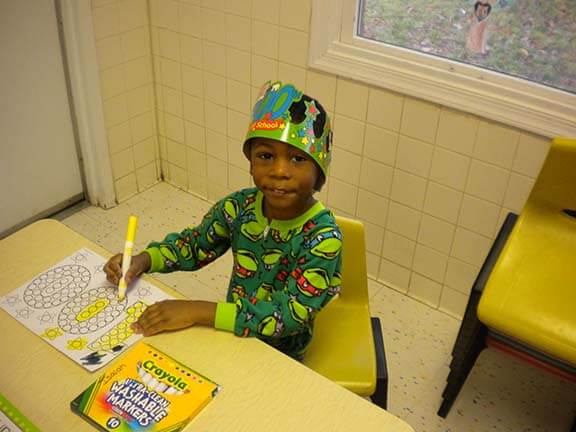

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Write your caption here

Contact Us Today

Tel:

(703) 256-3773

Email Us

Address:

5236 Backlick Rd, North Springfield, VA 22151

6574 Edsall Rd. Alexandria VA 22312

Payment Options

Browse Our Website

Contact Us Today

Tel:

(703) 256-3773

Email Us

Address:

5236 Backlick Rd, North Springfield, VA 22151

6574 Edsall Rd. Alexandria VA 22312

Payment Options

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy